1. Puerh as Financial Asset: The Case for Tea Investment

Why puerh differs from other teas: Improves with age (raw sheng puerh—astringent when young, mellows over 10-30 years develops complexity, unlike black/green tea which degrade see oxidation dynamics), finite vintage production (2005 Dayi 7542 cake—once production year ends, no more made, scarcity increases over time as consumption/loss reduces supply), collectible market established (China/Hong Kong/Taiwan—active secondary markets for aged puerh, price discovery transparent via auction houses/specialty dealers). Investment thesis: Dual appreciation (quality improvement—better taste commands premium, scarcity premium—fixed supply + growing demand as collectors/drinkers compete for shrinking inventory), historical precedent (1990s raw puerh—purchased ¥50-100/357g cake, 2020 resale ¥5,000-15,000, 50-150x return over 20-25 years, annualized 16-22% despite 2007 crash volatility).

Puerh vs. traditional investments: Stock market comparison (S&P 500 historical return ~10% annually—puerh collector-grade averages 12-18% over 20+ years, higher but illiquid + storage costs), wine investment parallel (Bordeaux first growth—similar age-appreciation dynamics, puerh less established Western market but growing, China domestic demand strong), commodity tea contrast (CTC black tea—depreciates immediately post-production, see commodity pricing, puerh unique among teas as appreciating asset). Risk factors unique to puerh: Storage risk (mold/pest damage—ruins entire investment if humidity control fails, 10-30% of amateur collectors experience losses), authenticity risk (counterfeit vintage cakes—common above ¥10,000 price point, see GI fraud patterns), liquidity risk (finding buyers—niche market, may take months to sell at fair price unlike stocks instant liquidity).

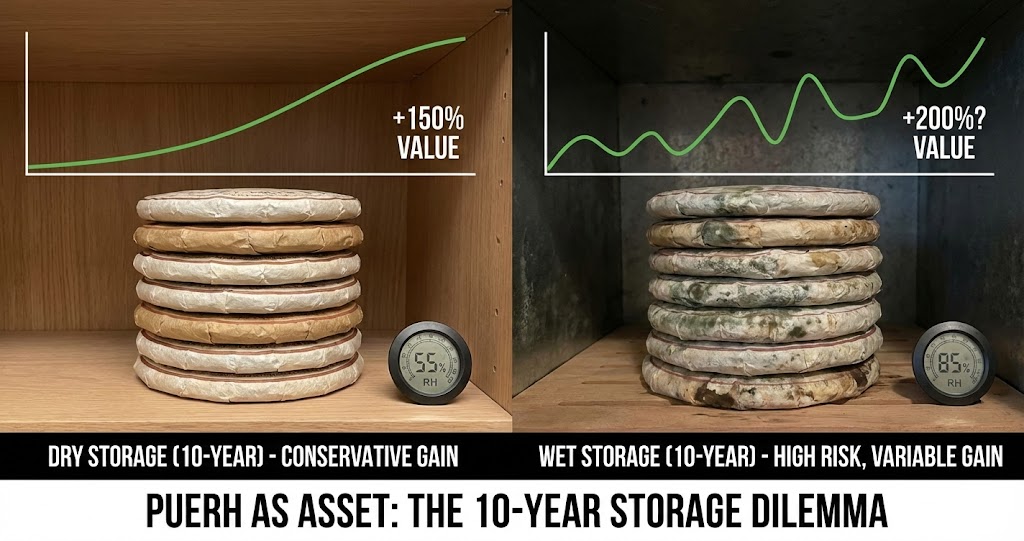

2. Dry Storage vs. Wet Storage: The 10-Year Return Divergence

Storage methodology definitions: Dry storage (natural aging) (Hong Kong/Guangzhou/Taiwan—55-65% relative humidity, 20-28°C temperature, slow microbial/oxidative transformation, preserves tea character), wet storage (accelerated aging) (70-85% humidity, 25-32°C, enclosed space—rapid microbial fermentation, "artificially aged" flavor develops 3-5 years vs. 15-20 dry, controversial practice). Flavor profile divergence: Dry storage outcome (15-20 years—complex woody/camphor/honey notes, bright clarity retained, prized by connoisseurs), wet storage outcome (musty/earthy/damp cellar notes—divisive profile, traditionalists consider inferior, Malaysian/Hong Kong older generation prefer, see taste preference fragmentation).

Market valuation comparison (10-year aged example): 2013 Menghai raw cake (dry storage): Purchase price 2013: ¥300/357g, 2023 market value: ¥2,000-3,500 (6.7-11.7x return, 20-28% annualized), condition premium (well-stored dry—commands 30-50% premium over average storage), liquidity advantage (dry storage sells faster—broader buyer base prefers clean profile). 2013 Menghai raw cake (wet storage): Same starting price ¥300, 2023 value: ¥800-1,500 (2.7-5x return, 10-18% annualized), wet storage discount (controversial flavor—limits buyer pool, 40-60% lower value vs. dry equivalent), selling challenges (niche buyers only—requires finding wet storage enthusiasts, may sit unsold months). Key insight: Dry storage wins financially (2-3x better returns over 10 years—plus easier resale, wet storage higher risk lower reward unless targeting specific niche market).

| Storage Method | 10-Year Return (Collector Grade) | 20-Year Return Estimate | Resale Liquidity | Risk of Total Loss |

|---|---|---|---|---|

| Dry Storage (Natural) | 6-12x (20-28% annual) | 30-100x (15-25% annual) | HIGH (broad buyer base) | LOW (5-10% if proper control) |

| Wet Storage (Accelerated) | 2.5-5x (10-18% annual) | 8-25x (10-18% annual) | MEDIUM (niche buyers) | MEDIUM (15-25% mold risk) |

| Poor Storage (Amateur) | 0.5-2x (-5% to +7% annual) | 0.2-3x (depreciation or minimal gain) | LOW (damaged goods discount) | HIGH (30-50% significant degradation) |

| Temperature-Controlled (Premium) | 8-15x (25-32% annual) | 50-150x (20-28% annual) | HIGHEST (verified storage provenance) | VERY LOW (<5% professional facility) |

3. The 2007 Puerh Crash: Lessons for Modern Investors

Buildup to the crash (2005-2007): Speculation frenzy (puerh prices quintupled 2005-2007—investors buying not to drink but flip, see speculation dynamics, taxi drivers/housewives entering market classic bubble sign), factory overproduction (Menghai/Xiaguan/CNNP—ramped output 300-500% to meet demand, quality declined as quantity prioritized, adulteration with lower-grade maocha common), leverage and credit (dealers buying on credit—pyramid scheme dynamics, new buyer money paid earlier buyers, unsustainable once inflows slowed). Trigger event: Media expose (March 2007) (Chinese national TV—investigative report on puerh fraud + overvaluation, public panic selling ensued), credit tightening (banks called loans—dealers forced liquidate inventory, supply flood crashed prices 70-90% within 6 months).

Post-crash recovery patterns: Junk puerh never recovered (2007 speculationgrade cakes—purchased ¥500-1,000, crashed to ¥50-150, 2023 still ¥100-200, permanent value destruction for low-quality overpriced tea), collector-grade recovered and exceeded (premium factory cakes 2005-2006—dropped 60-70% during crash, by 2015 exceeded pre-crash highs, 2023 up 5-10x from 2007 lows demonstrating fundamentals prevail long-term), vintage tea unaffected (1990s-2000s aged puerh—held value through crash, buyers shifted from speculation to genuine collector-grade during correction, flight to quality). Key lesson: Quality + storage matter (speculation-grade commodity puerh—terrible investment destroyed by crash, collector-grade with proper storage—weathered crash and appreciated, differentiate fundamentally sound assets from speculation froth).

Identifying Investment-Grade Puerh

Factory reputation critical: Tier 1 factories (Menghai Dayi, Xiaguan, CNNP state factories—consistent quality 40+ years, brand recognition supports resale value, premiums justified by reliability), boutique producers (Chen Sheng Hao, Douji—higher risk but potential outsized returns if quality exceptional, requires expert evaluation), avoid no-name brands (generic Taobao puerh—may be drinkable but zero investment value, no collector market exists for unknown producers). Material quality markers: Ancient tree (gushu) designation (Yiwu/Bingdao/Lao Banzhang regions—documented old-growth tea gardens, commands 5-10x premium over plantation tea, authentication difficult but critical for high-end investment), spring harvest specification (明前/清明 early spring—highest quality flush see flush economics, autumn harvest inferior investment grade), proper compression (tight beeng cha stone press—ages better than loose compression, factory technique consistency matters). Provenance documentation: Retain original packaging (neifei/wrapper intact—proves authenticity, removes = 20-40% value loss), storage history (documented climate control—or reputable warehouse storage, unknown storage = 30-50% discount risk).

4. Storage Costs and Total Return Calculations

Home storage economics (amateur investor): Dedicated space cost (spare room/closet—opportunity cost ¥500-1,500/month in major cities, climate control electricity ¥100-300/month), equipment investment (hygrometer/dehumidifier/air purifier—¥1,500-5,000 initial, ¥500-1,000 annual maintenance/replacement), insurance (homeowners rider for collectibles—¥500-2,000/year for ¥50,000-200,000 inventory, protects against fire/theft not mold). Total cost example: ¥100,000 puerh investment held 10 years (space + utilities ¥800/month × 120 months = ¥96,000, equipment ¥3,000 initial + ¥5,000 over 10 years = ¥8,000, insurance ¥10,000 total, TOTAL: ¥114,000 costs on ¥100,000 initial = 114% overhead, must triple in value just to break even after costs).

Professional storage alternative: Hong Kong/Guangzhou warehouses (specialist puerh storage—¥15-30 per kg per year, climate-controlled 20-25°C + 55-65% RH monitored 24/7), insurance included (most facilities—cover loss up to declared value, eliminates separate insurance cost), resale advantages (documented storage history—warehouse provenance adds 20-30% premium vs. unknown storage, buyers trust professional facilities over home storage claims). Cost comparison: 100kg puerh (approximately 280 cakes—typical collector scale, ¥20/kg/year × 100kg × 10 years = ¥20,000 storage cost, vs. ¥114,000 home storage for same period, 82% cheaper + better resale value, professional storage clearly superior for serious investors).

5. Liquidity Challenges: Finding Buyers for Aged Puerh

Market channels for resale: Taobao/Xianyu (online) (C2C platforms—broadest reach but buyer skepticism high, authentication difficult online, expect 20-30% discount vs. in-person sale to compensate risk), specialty tea shop consignment (shops take 15-25% commission—handles authentication + sales process, slower turnover 3-12 months typical), auction houses (China Guardian/Sotheby's Hong Kong—for ultra-premium only ¥10,000+ per cake, 10-15% buyer's premium + seller's commission, best price discovery but limited to high-end). Peer-to-peer networks: Tea forums/WeChat groups (Puerh Drunk/Teachat—direct buyer contact, no commission but requires established reputation + time investment building trust), tea club sales (local tastings—demonstrate quality in person, strongest prices but limited buyer pool constrains volume).

Time to liquidity estimates: Collector-grade dry storage: 2-8 weeks (strong demand—premium material moves quickly, established market makers provide liquidity), mid-tier wet storage: 2-6 months (niche buyers—must find right collector, wider spread between bid/ask), unknown storage/junk puerh: 6-18 months or never (saturated market—speculation-grade overproduced 2005-2007 still seeking buyers 15+ years later, see oversupply dynamics). Price realization: Premium material: 90-100% of fair value (competitive bids—multiple buyers for quality puerh), average material: 70-85% (discount for liquidity—quick sale requires haircut), distressed sale: 40-60% (forced liquidation—must move inventory immediately, buyers exploit urgency).

6. Counterfeiting and Authentication: The ¥50,000 Fake Risk

Prevalence of counterfeits by price tier: Under ¥500 cakes: 5-15% fake rate (not worth counterfeiting—margins too low, most authentic), ¥500-5,000 range: 20-40% fakes (profitable to counterfeit—common factories like Menghai 7542 frequently forged, authentication important), Above ¥10,000: 60-80% fakes (extreme counterfeiting—1980s/1990s vintage nearly all fake in public markets, reputable dealer purchase essential, see GI fraud parallels). Common forgery methods: Re-wrapper vintage cakes (take 2015 cake—rewrap in 1990s-style packaging, sell as aged vintage, paper aging techniques + fake seals, requires expert neifei examination to detect), wet storage acceleration fraud (young tea wet-stored 3-5 years—claimed as 15-20 year dry storage, taste profile mimics age but chemical markers betray, lab testing necessary for high-value purchases).

Authentication strategies: Buy from reputable dealers only (established tea shops—stake reputation on authenticity, markup 30-50% vs. Taobao but insurance against fakes worth premium), learn factory markers (wrapper printing nuances—Dayi logo evolution 1990s-2020s, neifei paper fiber analysis, compression patterns by factory era, expertise takes years develop), lab testing for major purchases (chemical analysis—¥500-2,000 per sample, age dating via oxidation markers, worthwhile for >¥10,000 cakes, eliminates most sophisticated fakes). Community verification: Tea forum experts (post photos of wrapper/neifei—experienced collectors spot fakes, free crowdsourced authentication, false negatives possible but useful filter), professional appraisal (Hong Kong/Guangzhou specialists—¥500-1,500 fee for authentication certificate, necessary for insurance/resale of high-value pieces).

7. Portfolio Strategy: Puerh as Alternative Asset (5-15% Allocation)

Recommended portfolio weighting: Conservative investor (low risk tolerance): 0-5% puerh (alternative asset risk too high—stick with stocks/bonds/real estate, puerh optional luxury only), moderate investor: 5-10% puerh (diversification benefit—uncorrelated with equities, Chinese market exposure, illiquidity acceptable for portion of portfolio), aggressive/tea enthusiast investor: 10-20% puerh (passionate knowledge advantage—personal expertise mitigates risks, consumption value hedges investment if prices stagnate). Within puerh allocation diversify: 60-70% collector-grade dry storage (core holdings—Menghai/Xiaguan established factories 10-20 years old, proven track record low risk), 20-30% boutique/emerging producers (higher risk/return—Chen Sheng Hao/Jingmai ancient tree, potential outsized gains if quality recognized), 10% speculation/young raw (current year purchases—hold 10-20 years, lottery ticket approach most will underperform but winners offset).

Rebalancing discipline: Annual portfolio review (assess puerh appreciation vs. other assets—if puerh grows to >20% portfolio weight, sell portion lock in gains reinvest equities, maintain target allocation prevents overconcentration), consumption as rebalancing (drink aged puerh—enjoyment factor unique to this asset class, 5-10% annual consumption rate natural rebalancing mechanism + value realization), market timing caution (puerh cycles 5-7 years—avoid selling into troughs or buying peaks, dollar-cost averaging annual purchases smooths volatility, see commodity cycles). Tax considerations (jurisdiction dependent—some countries tax collectibles at higher rates than capital gains, consult advisor, proper documentation critical for cost basis reporting when selling aged tea years later).

Exit strategy planning: Gradual liquidation (preferred): Sell 10-20% of holdings annually over 5-10 years (avoids flooding market—maintains pricing power, spreads tax impact, allows consumption of portion), bulk sale to dealer (quick exit): Accept 20-30% discount for immediate liquidity (useful for estate planning or urgent capital needs—cleanest execution but lowest price), bequest to heirs (long-term hold): Properly stored puerh lasts 50-100+ years (inter-generational wealth transfer—educate heirs on value + storage, step-up basis potential depending on jurisdiction). Risk of zero value: Unlikely for quality material (Chinese tea culture 2,000+ years—puerh demand enduring, 2007 crash demonstrated premium material recovers, total loss requires both quality failure AND cultural shift away from tea, low probability), diversification still essential (even strong conviction—no more than 20% net worth in puerh, alternative assets inherently riskier than liquid public markets).

Comments