The Tulip Mania of Tea

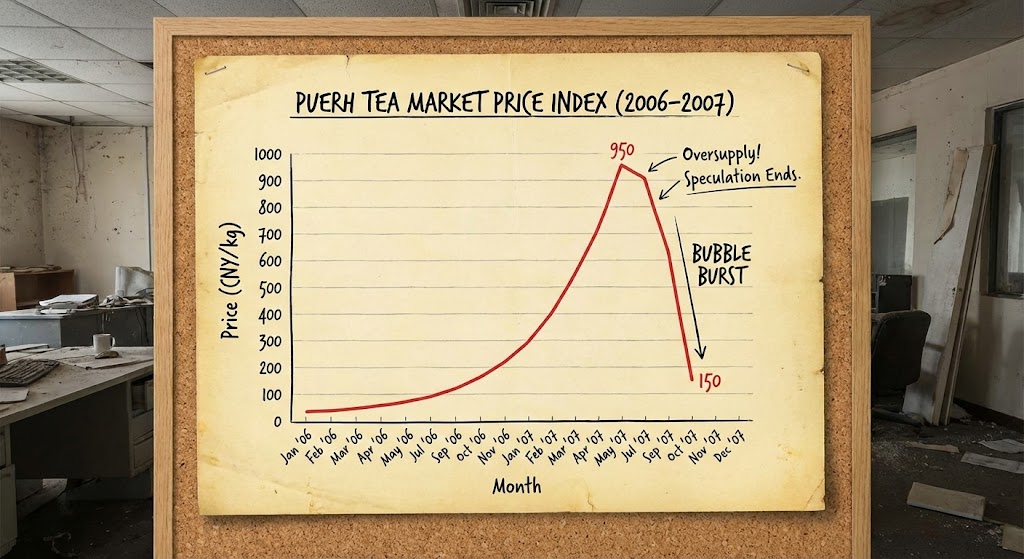

The 2007 Puerh crash mirrors Dutch Tulip Mania (1637) and every financial bubble since: rapid price inflation divorced from fundamentals, speculative mania replacing genuine collecting, and catastrophic collapse when new money stops flowing. Average Puerh prices rose 1000%+ in 18 months, then fell 90% in 3 months.

The Bubble Timeline: 2005-2007

2005: The Foundation (Pre-Bubble Conditions)

Puerh had been slowly gaining collector interest since the 1990s. Hong Kong storage warehouses marketed "aged" tea, Taiwan collectors developed Gongfu appreciation rituals, and Yunnan farmers began branding specific mountains as premium terroir. Prices were stable: factory tea £5-20/kg, premium ancient tree £50-150/kg. Market was small, collectors genuine, and speculation minimal.

Key shift: Guangdong businessmen (experienced in real estate speculation) discovered Puerh as alternative investment. They brought speculative capital, wash trading techniques, and get-rich-quick narratives. This injected external money into what had been insular collector market.

2006: The Acceleration (Mania Begins)

Prices doubled, then tripled. Tea that cost £20/kg in 2005 sold for £200/kg by late 2006. Pig farmers, taxi drivers, and restaurant workers quit jobs to become full-time tea traders. Everyone had stories of friends getting rich—classic bubble psychology where recent gains predict future gains.

Factories couldn't keep up with demand. Menghai Factory (largest producer) ran three shifts, 24-hour production. New factories opened weekly. Quality declined—wet storage accelerated aging to meet "vintage" demand, chemical additives enhanced flavor, and origin fraud became systematic (Lao Ban Zhang labels applied to any Menghai-region tea).

| Year | Avg Factory Price | Avg Premium Price | Market Participants | Production Volume |

|---|---|---|---|---|

| 2005 | £8/kg | £80/kg | ~5,000 serious collectors | 15,000 tons |

| 2006 | £40/kg (+400%) | £350/kg (+337%) | ~50,000 speculators | 45,000 tons (+200%) |

| 2007 (Peak) | £120/kg (+200%) | £800/kg (+128%) | ~200,000+ traders | 90,000 tons (+100%) |

| 2007 (Crash) | £12/kg (-90%) | £80/kg (-90%) | ~5,000 remaining | 100,000 tons unsold |

| 2008 | £6/kg (-50%) | £40/kg (-50%) | ~2,000 collectors | Factory closures |

Early 2007: Peak Insanity

Ordinary factory tea (fresh production, no aging) sold for £100-200/kg—prices previously reserved for 20-year aged tea. Taxi drivers discussed Puerh investment strategies. Families mortgaged homes to buy tea. Banks accepted tea as collateral for business loans. Auction houses ran daily sales; major lots sold within minutes.

The speculation was self-fulfilling: prices rose because people believed they would rise. No one drank the tea—it was pure accumulation for resale. Warehouses filled with unsold inventory. The market required constant new buyers to sustain prices (classic Ponzi structure).

Bubble Warning Signs (Present in 2007, Visible Today)

- Price disconnected from utility: Tea bought for resale, not drinking

- Rapid price acceleration: 100-500% gains in 12-18 months

- Amateur participation: Non-collectors entering market for profit

- Leverage and debt: Mortgages, business loans used to buy tea

- Production explosion: Supply increases to meet speculation

- Quality decline ignored: Buyers don't care about taste, only price

- Exit narrative dominance: Everyone plans to sell higher, no one plans to drink

The Crash: May-June 2007

The Trigger: Guangdong Businessmen Exit

The same speculators who inflated the bubble recognized unsustainability and began selling. Unlike amateur traders (emotionally attached to "tea riches" narrative), professional speculators took profits and left. When major buyers disappeared, prices stalled. Stalled prices triggered panic selling. Panic selling caused crash.

Within 3 months (May-July 2007), prices fell 70-90%. A £800/kg "premium" cake became £80. Factory tea fell from £120 to £12. £500M+ in paper wealth evaporated. Warehouses held unsold inventory worth fraction of purchase price. Farmers who'd planted new tea trees (3-year maturity) faced worthless harvest.

The Aftermath: Casualties and Lessons Ignored

Suicides: Multiple reports of traders jumping from buildings after losing life savings. Bankruptcies: Families lost homes used as collateral for tea purchases. Factory closures: 60%+ of new factories closed within 12 months. Unsold inventory: Estimated 100,000+ tons of tea sat unsold, slowly degrading.

Most tragic: genuine tea was destroyed by bubble. Quality producers who'd spent decades building reputation were lumped with scam factories. Collectors who actually drank tea left market entirely. The bubble didn't just crash prices—it poisoned tea culture for years.

Why Didn't People See It Coming?

Every bubble participant knows intellectually that bubbles burst. But loss aversion and groupthink create willful blindness. Selling means admitting you bought at peak (psychological loss). Staying in means hope of recovery. Everyone waits for "one more peak" to exit. By the time they accept it's over, it's too late.

Post-Crash Market Evolution (2008-2025)

The "Smart Money" Learned Wrong Lessons

Surviving speculators didn't leave tea—they refined their methods. Modern Puerh speculation is more sophisticated:

- Slower price increases: 20-50% annually (looks "sustainable") instead of 1000% spike

- Better storytelling: Emphasis on terroir, vintage, and craft rather than naked speculation

- Smaller market: Target wealthy collectors willing to pay £500-5,000/kg, avoid mass-market mania

- International distribution: Sell to Europe/US buyers unfamiliar with 2007 crash history

- Wash trading professionalization: Shell companies, auction manipulation, fake scarcity narratives

This means the bubble didn't end—it went underground. Prices are again unsustainable, but inflation is gradual enough that participants deny it's speculation.

Is Another Crash Coming?

| 2007 Bubble Indicator | 2025 Status | Risk Assessment |

|---|---|---|

| Rapid price acceleration | Moderate: 20-50%/year vs 1000% | ⚠️ Medium |

| Amateur participation | Low: Market smaller, more exclusive | ✅ Low |

| Production explosion | Moderate: Ancient tree planting ongoing | ⚠️ Medium |

| Price-utility disconnect | High: Most "investment" tea never drunk | ❌ High |

| Leverage/debt financing | Moderate: Less extreme than 2007 | ⚠️ Medium |

| Exit narrative dominance | High: "Appreciation" central to marketing | ❌ High |

| New money influx needed | High: Requires wealthy Western buyers | ❌ High |

Warning Signs of Bubble 2.0

Yes, another crash is likely. Current market has critical bubble characteristics:

1. Prices Require Continuous New Buyers: If Western collectors stop entering market, who buys from Chinese holders? Accumulators need exit liquidity. When new money stops, prices fall.

2. Ancient Tree Tea Supply Explosion: Yunnan farmers planted thousands of new "ancient tree" gardens post-2007. These mature 2020-2030. Supply will flood market, but demand narrative (scarcity) can't acknowledge this without destroying prices.

3. Generational Shift: Chinese collectors aging out; younger generation prefers coffee, convenience. Western market is small. Who sustains £500/kg prices in 10-20 years when current buyers retire/die?

4. Forensic Testing Threat: As radiocarbon dating and isotope analysis become cheaper, mass testing could expose systematic fraud, destroying market confidence overnight.

How to Protect Yourself from Crash 2.0

- Buy only tea you'll drink: If crash happens, you still have consumable product

- Ignore "investment" narrative: Appreciation is speculation, not guarantee

- Avoid debt for tea purchases: Never mortgage, loan, or leverage for tea

- Diversify storage: Don't put life savings in single asset class (even tea you drink)

- Recognize bubble psychology: If everyone says "this time is different," it's the same

- Sell appreciated tea gradually: Take profits over time rather than waiting for "peak"

- Buy from post-crash survivors: Vendors who survived 2007 have long-term perspective

The Economics of Bubbles: Why They Always Burst

The Greater Fool Theory

Bubble participants know prices are inflated but believe they can sell to "greater fool" before crash. This works temporarily (early buyers profit by selling to late buyers), but mathematically guarantees crash (pyramid runs out of new fools).

Puerh 2007: Early buyers (2005) did profit by selling to late buyers (early 2007). But late buyers had no one to sell to—they were the terminal fools. Same pattern will repeat: current buyers accumulating £500/kg tea need buyers willing to pay £800/kg. Where do those buyers come from?

Supply-Demand Mismatch Hidden by Speculation

True tea demand (drinking consumption) is stable: ~15,000 tons/year globally for premium Puerh. Speculative demand (investment holding) created artificial demand for 90,000 tons in 2007. When speculation stopped, 75,000 tons of excess supply emerged instantly. Prices crashed to clear inventory.

Current market: Production ~40,000 tons/year, drinking demand ~20,000 tons. The 20,000-ton difference is speculation. If speculation stops (crash trigger), prices must fall to clear excess.

Can Regulation Prevent Crashes?

No, because tea market is intentionally unregulated—this is why speculators like it. Regulation would require: age verification (carbon dating), origin certification (isotope testing), and anti-manipulation rules (auction oversight). Industry resists because fraud is the business model. Bubbles will continue until regulation or catastrophic crash forces change.

Lessons from 2007 for Today's Buyers

Lesson 1: Narratives Change, Math Doesn't. 2007 narrative: "China's rising wealth will support prices forever." Reality: wealth rose, tea prices crashed anyway. Current narrative: "Western collectors create sustainable premium." Reality: Western market is tiny; can't support Chinese inventory.

Lesson 2: Quality Doesn't Protect You in Crash. Best tea and worst tea both fell 90% in 2007. Genuine Lao Ban Zhang ancient tree crashed alongside factory fraud. In panic selling, distinction disappears—everything liquidates at distress prices.

Lesson 3: "It's Different This Time" Is Always Wrong. Every bubble believes it's rational, sustainable, backed by fundamentals. 2007 believed Chinese culture supported tea prices. Tulip Mania believed scarcity supported bulb prices. Dotcom believed internet changed economics. All crashed. Current Puerh bubble believes terroir/craft narrative makes it different. It doesn't.

Conclusion: Drink Your Tea, Don't Speculate With It

The 2007 crash taught one clear lesson: tea is consumable, not investible. Buy tea you love, drink it within 2-10 years, enjoy the experience. Ignore appreciation narratives, auction hype, and investment "opportunities." These are criminal infrastructure or delusional speculation—either way, you're the exit liquidity.

If you can't afford to lose 90% of tea's "value" overnight, don't buy at speculative prices. The bubble will burst again. We don't know when, but we know it will. Mathematics guarantees it.

The pig farmers learned this the hard way. Don't be the next generation's cautionary tale.

Comments