1. Fair Trade Premium Structure: The Guaranteed +10-20% Floor

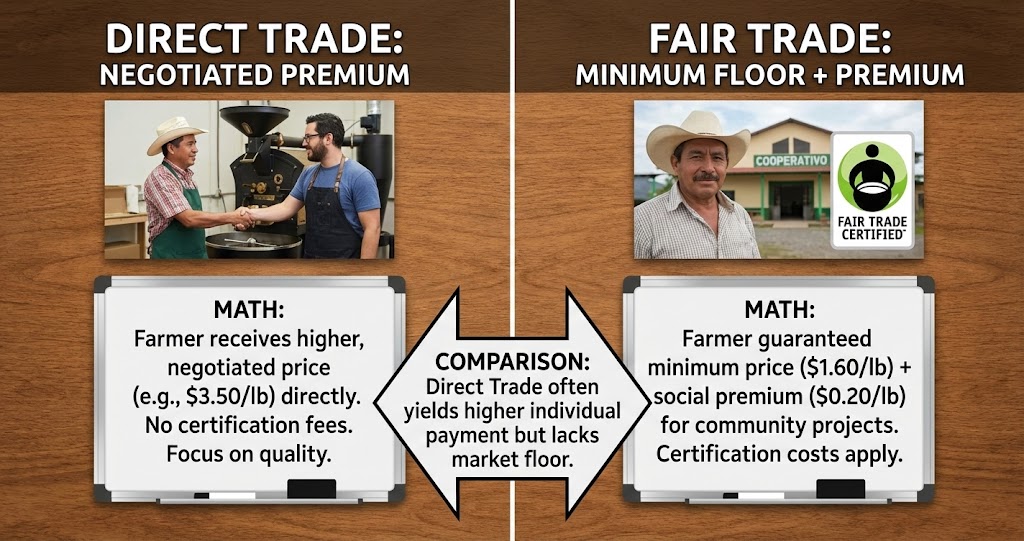

Fair Trade certification fundamentals: Fairtrade International (FLO) standards (minimum price floor—$1.40/kg for black tea conventional, $1.60/kg organic, +$0.30/kg social premium for community projects, guaranteed regardless of commodity market see commodity pricing), who benefits (smallholder cooperatives only—estates not eligible unless demonstrating worker ownership, 45,000-60,000 tea farmers certified globally, concentrated Sri Lanka/India/Kenya/Malawi), market access advantage (retail shelf space—Tesco/Sainsbury's mandate Fair Trade options, consumer willingness to pay 10-15% premium for ethical label, brand differentiation in crowded market). Premium calculation example: Commodity Kenyan CTC: Mombasa auction price $2.50/kg (non-certified—fluctuates with market, farmer receives $1.80-2.00/kg after middlemen, see auction value chain), Fair Trade equivalent: Minimum $1.40/kg + social premium $0.30/kg = $1.70/kg floor (protects against market crashes, 2008 commodity slump saw non-FT drop to $1.20/kg while FT held $1.70—40% premium during crisis).

Social premium allocation mechanics: Cooperative decision-making ($0.30/kg social premium—separate from farmer payment, used for community projects schools/clinics/infrastructure, democratic vote by cooperative members on allocation), typical uses (40-50% education—school construction/scholarships, 25-35% healthcare—mobile clinics/sanitation, 15-20% agricultural investment—irrigation/equipment, 5-10% administration—cooperative management costs), transparency reporting (annual audits—FLO requires documentation of premium spend, public reports accessible to consumers, differentiate from vague "ethical sourcing" claims by conventional brands). Retailer margin impact: Tesco Fair Trade tea: Farm gate $1.70/kg + shipping/packing $1.00/kg + retailer/brand margin $1.80/kg = retail £4.50 per 80-bag box (vs. non-FT £3.50—30% consumer premium for 10-15% farmer benefit, retailer captures 50-60% of consumer premium as margin expansion, see tea bag margin breakdown).

2. Direct Trade Model: The +30-100% Relationship Premium

Direct trade definition (no standardized certification): Roaster/importer direct relationships (bypass auction/broker/exporter—buyer visits estate, negotiates directly with producer, multi-year purchasing commitment typical, see direct logistics), price premiums variable ($3.50-6.00/kg common vs. $2.50 auction—40-140% premium depending on quality/relationship/exclusivity, no guaranteed floor unlike Fair Trade but typically exceeds FT minimum by 2-4x for specialty tea), who practices direct trade (specialty roasters—Rare Tea Company/What-Cha/Jing Tea, volumes 5,000-50,000kg annually vs. Unilever 100M+ kg, niche market <3% global tea trade but growing 15-20% annually). Transparency emphasis: Know-your-farmer marketing (estate name/photos—Mr. Chen Yiwu puerh producer, narrative storytelling "fourth generation tea maker", consumer connection justifies premium vs. anonymous commodity supply chain), traceability to production day (specific harvest dates—"April 8 2023 first flush Darjeeling", batch-level quality control, contrasts with commodity blends mixing 20-30 estates for consistency, see flush precision).

| Model | Farmer Price Premium vs. Commodity | Certification Cost (Annual) | Volume Scale | Consumer Retail Premium |

|---|---|---|---|---|

| Commodity Auction | 0% (baseline $1.80-2.50/kg) | $0 (no certification) | MASS (500,000+ tonnes annually) | 0% (baseline £3-4 per 80-bag box) |

| Fair Trade Certified | +10-20% (floor $1.70/kg + social premium) | $2,000-5,000 cooperative | MEDIUM (50,000-100,000 tonnes) | +15-30% (£4.50-5.50) |

| Rainforest Alliance | +5-12% ($1.90-2.80/kg typical) | $3,000-8,000 estate | LARGE (200,000+ tonnes estates) | +10-20% (£4.00-5.00) |

| Direct Trade (Specialty) | +40-140% ($3.50-6.00/kg negotiated) | $0 (no third-party cert) | SMALL (niche 5,000-50,000kg per buyer) | +100-300% (£10-25 per 50-100g) |

| Organic Certified (any model) | +15-30% ($2.30-3.25/kg) | $1,500-4,000 annual audit | GROWING (80,000-120,000 tonnes) | +25-50% (£5-7) |

Direct trade payment structure: Advance payment common (30-50% prepayment at harvest—reduces farmer financing burden, buyer assumes crop risk weather/quality, trust-based relationship vs. transactional auction model), quality incentives tiered pricing (base price $4.00/kg + bonuses—$0.50/kg for <5% defect rate, $0.30/kg for on-time delivery, $0.40/kg for exclusivity agreement, aligns farmer incentives with buyer quality needs), multi-year contracts stability (3-5 year purchasing commitments—farmer can invest in quality improvements knowing market secured, buyer locks supply preventing competitor access, see origin exclusivity value). Risk allocation differences: Fair Trade: Cooperative bears crop risk (poor harvest—farmer receives less volume × fixed price, buyer commitment only to purchase "as needed" not guaranteed volume), Direct Trade: Buyer often absorbs risk (contracted volume—buyer pays even if harvest short must source elsewhere, or quality bonus forgone if weather damages crop, stronger partnership vs. Fair Trade arms-length transaction).

3. Certification Costs and Scale Economics

Fair Trade certification expense breakdown: Initial certification ($2,000-3,500 for cooperative—FLO auditor inspection, documentation review, 6-12 month process from application to approval), annual renewal ($1,500-2,500 per year—ongoing audits, paperwork maintenance, proportional to cooperative size), cost per farmer (500-farmer cooperative—$5-10 per farmer annually affordable, 50-farmer small co-op—$50-70 per farmer prohibitive, scale barrier excludes smallest producers). Who pays certification cost? Cooperatives front cost: Expect recoup via premium sales (break-even if sell 20-40% of crop as Fair Trade—most co-ops sell 30-60% FT remainder commodity, certification gamble on market access), donor/NGO support common: Initial certification funded by development orgs (USAID/Oxfam/Rainforest Alliance—promote FT adoption, reduces barrier to entry, ongoing renewal must self-fund from tea sales).

Rainforest Alliance (RA) estate certification: Higher absolute cost ($3,000-8,000 annual—estate scale larger than cooperative, more complex audit trails labor/environmental compliance, 200-500 hectare estate typical), cost per kilogram lower (1M kg production—$0.003-0.008/kg certification overhead negligible, absorbed easily in $2.50-3.00/kg auction price), why estates choose RA over Fair Trade (Fair Trade excludes estates unless worker-owned—plantation model ineligible, RA accepts estates meeting labor/environmental standards, Unilever/Twinings prefer RA for estate tea sourcing compatibility). Organic certification overlap: Combined FT + Organic (common pairing—$3,500-7,000 total annual cost for both, unlocks dual premium $1.60/kg FT organic minimum vs. $1.40 conventional FT, justifies cost if 40-60% of crop sold into organic market), audit synergy (single auditor often covers both—shared documentation reduces duplication, but separate standards mean no cost savings on compliance itself only inspection process).

The Fair Trade Paradox: Why Premiums Don't Always Reach Farmers

Cooperative governance challenges: Elite capture risk (co-op leadership—may prioritize personal benefit over membership, social premium allocation vote manipulated by dominant families, 15-25% of FT co-ops face governance disputes reducing trust), volume commitment mismatch (retailer buys 30% of crop Fair Trade—remaining 70% sold commodity price, average farmer receives blended price only 5-10% above non-FT neighbor not full 20% premium marketed to consumers, see retail margin capture). Opportunity cost of Fair Trade compliance: Quality sacrifice pressure (FT standards emphasize volume/social compliance—NOT quality maximization, farmer may earn more focusing quality + direct trade $5/kg vs. Fair Trade $1.70/kg even accounting for FT volume advantage, best producers often abandon FT after building reputation), administrative burden (record-keeping requirements—25-40 hours annually per co-op for FT audits, small farmers opportunity cost $300-600 if spent on farming instead, larger co-ops amortize cost better, see scale economics). When Fair Trade works best: Commodity producers (CTC bulk tea—quality differentiation limited, FT minimum price protection valuable when market crashes below $1.70/kg, 2008-2009 financial crisis FT premiums most impactful), when direct trade superior: Specialty producers (orthodox whole-leaf—quality commands premium naturally, direct relationships pay 2-4x FT minimum, certification overhead not justified, estate reputation more valuable than FT label).

4. Farmer Payment Comparison: The $1.80 vs. $4.50/kg Reality

Commodity supply chain (CTC black tea Kenya example): Mombasa auction hammer price: $2.80/kg BP1 grade (see auction mechanics, market-determined price fluctuates ±15-20% monthly), minus broker commission: -$0.05/kg 1.5-2% (broker earns commission facilitating sale), minus exporter margin: -$0.15-0.25/kg (aggregates small lots, handles export logistics, currency risk premium), minus transport to auction: -$0.08-0.12/kg (estate to Mombasa 200-400km), farmer receives: $2.30-2.50/kg (vs. $2.80 hammer price—18-20% supply chain cost, auction model transparency advantage vs. opaque intermediaries). Smallholder further deductions: Bought-leaf factory processing: -$0.30-0.50/kg (smallholder sells fresh leaf to factory—factory withholds processing cost + margin before paying farmer), net to farmer: $1.80-2.00/kg (final payment—35% below auction price, explains Fair Trade appeal minimum $1.70/kg protects against exploitation when auction drops).

Fair Trade supply chain alternative: Fair Trade minimum floor: $1.40/kg conventional black tea (FLO mandated—regardless of commodity market, protects farmer when Mombasa auction crashes to $1.20/kg during oversupply), plus social premium: +$0.30/kg (cooperative community projects—NOT individual farmer pocket, schools/clinics benefit entire village), farmer individual payment: $1.40-1.60/kg (social premium excluded—individual farmer receives minimum only unless co-op votes cash distribution rare, less than commodity example above BUT guaranteed floor prevents worst exploitation), when FT premium activates (market crashes—2008/2020 commodity prices $1.10-1.30/kg, Fair Trade $1.70/kg = 30-50% premium those crisis years, normal markets FT ≈ commodity or even lower). Organic Fair Trade premium stack: Organic minimum: $1.60/kg (vs. $1.40 conventional—$0.20/kg organic premium), plus social premium: +$0.30/kg, total: $1.90/kg to farmer + co-op (competitive with commodity good years—superior during commodity slumps, justifies organic certification cost $1,500-4,000 annually if 60-80% crop sold certified).

Direct Trade specialty supply chain: Negotiated estate price: $4.50/kg Darjeeling first flush orthodox FTGFOP (buyer visits estate—directly negotiates with owner/manager, no auction/broker intermediary, see first flush logistics), estate pays workers: $1.50-2.50/kg labor cost (pluckers—daily wage ₹250-400 = $3-5/day, 2-3 kg fresh leaf per day = 0.5-0.75 kg made tea equivalent, $2-3/kg labor input), estate margin: $2.00-3.00/kg (factory depreciation/management/risk premium—estate profit vs. smallholder co-op structure, but workers receive stable wage vs. volatile smallholder income). Direct trade cooperative model: Farmer receives full $4.50/kg minus minimal costs: Transport $0.10/kg + cooperative admin 5-8% = farmer nets $4.00-4.20/kg (vs. commodity $1.80-2.00/kg—125% premium, vs. Fair Trade $1.40-1.60/kg—160% premium, quality + relationship premium dwarfs certification premiums).

5. Quality Incentives: How Premium Models Shape Farming Decisions

Fair Trade quality problem: Minimum price disconnect from quality (FT guarantees $1.40/kg—whether excellent or mediocre tea, farmer incentive to maximize volume NOT quality, 5-10% quality decline observed in some FT co-ops vs. pre-certification baseline), democratic pricing constraint (co-op votes on pricing—cannot differentiate payments by farmer quality, high-quality producers subsidize low-quality members, best farmers leave FT co-ops frustrated by averaging, see quality fragmentation). Commodity auction quality signals: Price differentiation by grade: BP1 $2.80/kg vs. PF1 $2.50/kg vs. Dust $1.80/kg (particle size/quality hierarchy—rewards better processing, farmer sees correlation between quality and payment via factory feedback, see grade economics), estate reputation premium: Marinyn BP1 $3.20/kg vs. generic Kenya BP1 $2.80/kg (consistent quality—builds brand 15-20% premium, long-term incentive to maintain standards).

Direct trade quality alignment: Price tied explicitly to quality metrics: Buyer pays $4.00/kg base + $0.50/kg if <5% defect rate + $0.30/kg if muscatel notes present (objective + subjective criteria—farmer knows exactly what drives payment, strong incentive to optimize plucking/processing for buyer preferences), immediate feedback loop (buyer visits 2-4x per year—tastes samples, provides real-time feedback on quality trajectory, coaching relationship vs. transactional auction sale, farmer improves skills faster). Exclusivity agreements drive investment: Buyer commits 5-year purchase: Farmer invests in irrigation $15,000 (payback 3-4 years at $4.50/kg direct trade price—impossible to justify at $1.80/kg commodity, long-term relationship enables capital investment cycle), quality improvement compounding (year 1: $4.00/kg → year 3: $4.80/kg as quality improves—25% gain over contract period vs. Fair Trade fixed $1.40/kg or commodity volatile $1.50-2.50/kg, strongest farmer wealth creation model but requires initial quality threshold to attract direct trade buyer).

6. Scale and Market Access: Who Benefits from Each Model?

Fair Trade sweet spot: Medium-scale cooperatives 200-800 farmers (certification cost $2,000-5,000 spread over members = $6-15 per farmer affordable, co-op production 500-2,000 tonnes—sufficient volume to interest Tesco/Sainsbury's but not so large certification overhead prohibitive), commodity producers seeking stability (CTC black tea—quality differentiation limited, FT minimum price insurance valuable, specialty tea producers better served by direct trade higher premiums), risk-averse farmers (guaranteed floor—reduces income volatility, appeals to older farmers/widows/disabled who cannot compete on quality, social safety net function Fair Trade provides beyond pure economics). Rainforest Alliance estate fit: Large plantations 200-1,000 hectares (estate model—excluded from Fair Trade, RA provides ethical sourcing credential for Unilever/Tata/Twinings corporate supply chains), labor compliance focus (RA standards emphasize worker rights/wages/safety—NOT farmer ownership like FT, suitable for hired labor model which dominates Assam/Sri Lanka production).

Direct trade constraints: Specialty quality prerequisite (buyer seeks exceptional tea—typically top 5-10% quality tier, commodity producers cannot access direct trade pricing even with relationships), volume limitations per buyer (specialty roaster—buys 5,000-50,000kg annually total across multiple origins, single estate may sell only 1,000-5,000kg direct trade, remaining production still commodity/FT channels, diversified market strategy necessary), farmer business skills required (direct trade negotiation—farmer must understand costing/quality assessment/logistics, vs. Fair Trade/commodity where co-op manager handles business side, education/language barriers limit direct trade access to elite farmers). Hybrid models emerging: Cooperative with direct trade boutique line (co-op maintains Fair Trade certification for commodity volume—60-70% of production, top 10-15% farmers produce specialty batch sold direct trade $5-8/kg, blended revenue model optimizes income stability + premium capture, see flush quality stratification).

7. Consumer Willingness to Pay: Do Ethical Premiums Reach the Farm?

Retail price premium analysis: Tesco Fair Trade tea £4.50 vs. standard £3.50 (consumer pays 30% premium—£1.00 extra for 80-bag box), farm gate increase £0.02-0.04 per box (Fair Trade minimum $1.70/kg vs. commodity $1.50/kg = $0.20/kg premium × 160g tea per box = £0.02-0.03 farmer benefit), retailer captures £0.70-0.85 of consumer premium (margin expansion—retailer/brand split majority of consumer ethical premium, farmer receives <5% of consumer overpayment, see retail margin breakdown). Why consumer premium disconnect? Certification rarity premium: Retailer prices FT tea to capture consumer willingness to pay (surveys show 35-45% consumers willing to pay 20-30% premium for ethical label—retailer charges upper bound of willingness, farm gate premium independent of retail pricing), volume economics ignored (consumer assumes higher price = higher farmer payment—actually reflects retailer margin opportunity + certification scarcity premium in retail shelf space).

Direct trade transparency advantage: Specialty roaster $18 per 100g Darjeeling (consumer pays 3-5x commodity tea price—expects premium quality + farmer benefit), farm gate $4.50/kg × 100g = $0.45 farmer payment (consumer pays $18—farmer receives $0.45 = 2.5% of retail price), BUT farmer premium vs. commodity 125% (farmer receives $4.50/kg vs. $2.00/kg commodity—$2.50/kg absolute premium, consumer overpayment $14.50 goes to roaster margin $6-8 + import/logistics $3-4 + packaging $2-3, farmer premium still substantial despite small % of retail). Consumer perception vs. reality: Fair Trade branding effective (70% consumers believe FT means "most money to farmers"—certification/marketing success, reality: direct trade often pays 2-4x FT minimum but lacks consumer awareness), transparency initiatives emerging (QR codes on packaging—scan to see farm gate price/farmer name/payment breakdown, What-Cha/Rare Tea Co. pioneers, builds trust + justifies specialty premiums, see origin authenticity signaling).

Optimal model by farmer context: Commodity smallholder: Fair Trade (income protection—minimum price floor valuable, co-op provides market access + technical support individual farmer lacks, social premium community benefit), Quality-focused estate: Direct trade (premium maximization—$4-8/kg vs. FT $1.70/kg, relationship investment worthwhile for top-tier producers, brand-building long-term strategy), Large plantation: Rainforest Alliance (estate eligibility—FT excludes, RA provides ethical credential for corporate buyers, cost per kg negligible at scale), Diversified co-op: Hybrid model (FT for base volume stability—60-70% production, direct trade for specialty 10-20%—maximizes revenue + quality incentives, organic certification stacks premiums, most resilient to market volatility, see recession revenue protection).

Comments