1. The £2 Tea Bag Box: Who Gets What?

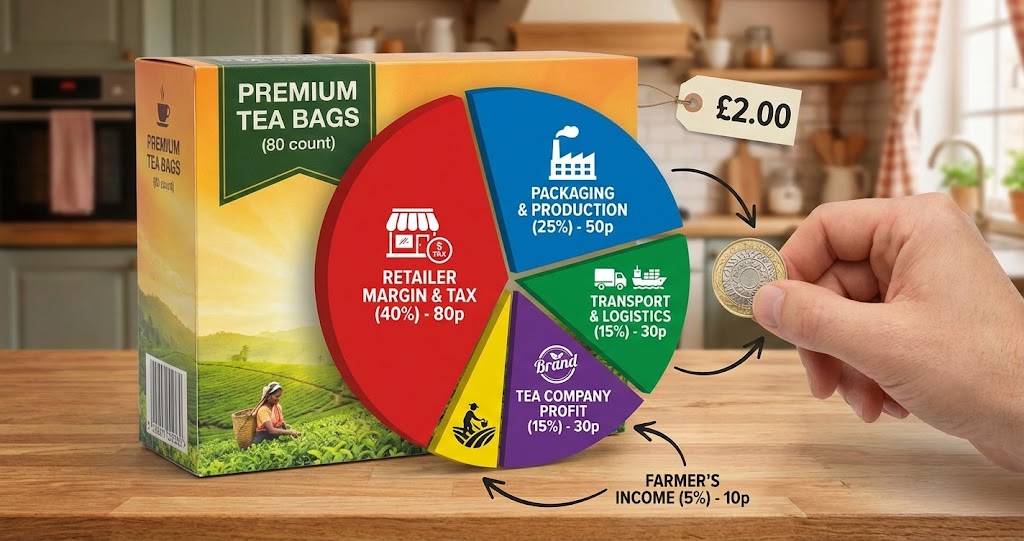

Standard supermarket tea bag economics (80-bag box £2): Per-bag cost breakdown: £2 ÷ 80 bags = £0.025 per bag (2.5 pence), tea content per bag (2-2.5g average—standard CTC blend, 80 bags × 2.25g = 180g tea total in box), cost per kilogram equivalent (£2 ÷ 0.18kg = £11.11/kg—consumer pays 4-5x wholesale tea price for packaging/brand/retail markup). Value chain participants: Tea farmer (1-2% of retail price—£0.02-0.04 per box, $2.50-3.00/kg at auction for CTC, see auction prices), packer/brand (25-35%—£0.50-0.70, covers procurement + blending + packaging + marketing + profit), retailer (35-45%—£0.70-0.90, Tesco/Sainsbury's markup), taxes + logistics (15-20%—£0.30-0.40, VAT + transport + warehousing).

Why farmers get only 1-2%: Commodity bulk pricing (CTC tea $2.50-3.00/kg wholesale—oversupplied market see market dynamics, 180g box contains £0.45-0.54 ($0.55-0.65) worth of raw tea at auction prices), minimal farmer bargaining power (smallholders—sell to estates or cooperatives at further discount, estate pays pickers £200-300 ($2.50-3.50) per month harvest ~50kg/day, works out <£0.01 per 2.5g tea bag worth of picked leaf). Value-add capture by processing/branding: Tea leaf → packaged product (raw material 2% → finished consumer good 100%—processing/branding/retail capture 98%, classic agricultural commodity pattern see fair trade attempts to rebalance).

2. Tea Bag Manufacturing Costs: The 0.2p Economics

Physical components per bag: Filter paper (0.15-0.25 pence—abaca hemp or wood pulp, see paper supply chain, biodegradable vs. plastic mesh cost difference), string + tag (0.03-0.05 pence—cotton string + small paper tag with brand, premium brands omit to save costs or use tagless bags), staple/heat-seal (0.01 pence—metal staple traditional, heat-seal plastic-free premium costs 2-3x more). Labor + machinery: Automated packing lines (produce 300-500 bags per minute—minimal labor cost £0.001-0.002 per bag amortized, capital investment £200,000-500,000 per line requires scale to justify), blending labor (tea master + workers—blend different estate teas for consistency, allocate across millions of bags costs £0.005-0.01 per bag).

Total manufacturing cost per bag: Tea content: 0.6-0.8p (2.25g at $3/kg wholesale = £0.0067 or 0.67 pence), filter paper + string: 0.2-0.3p, box packaging: 0.1-0.15p (cardboard box + printing ÷ 80 bags), labor + overhead: 0.1p, TOTAL: 1.0-1.35 pence per bag. Packer margin: Sells to retailer at 1.5-1.8 pence per bag (× 80 = £1.20-1.44 wholesale box price), retailer buys at £1.20 sells at £2.00 (markup 66%—standard FMCG retail margin), packer gross margin 25-35% (1.5p sell price - 1.1p cost = 0.4p profit per bag, nets £0.30-0.40 per box before SG&A/marketing).

| Cost Component | Cost Per Bag (pence) | Cost Per 80-Bag Box (£) | % of Retail Price |

|---|---|---|---|

| Tea (2.25g CTC) | 0.65p | £0.52 | 26% |

| Filter Paper + String | 0.25p | £0.20 | 10% |

| Box + Packaging | 0.12p | £0.10 | 5% |

| Labor + Overhead | 0.10p | £0.08 | 4% |

| Packer Margin | 0.38p | £0.30 | 15% |

| Retailer Margin | 0.75p | £0.60 | 30% |

| Tax (VAT 20%) | 0.25p | £0.20 | 10% |

3. Brand Premiums: Why PG Tips Costs 3x Supermarket Own-Label

Price comparison (80-bag boxes): Tesco own-label (£1.50-2.00—uses same CTC sources as branded, minimal marketing spend, functional packaging), PG Tips/Tetley (£3.50-4.50—national TV advertising, brand equity 100+ years, premium packaging + innovations like pyramid bags), Yorkshire Tea (£3.00-4.00—regional brand premium, "proper northern tea" positioning, see cultural branding), specialty loose leaf (£6-12 per 250g—equivalent to £1.92-3.84 per 80g if bagged, premium positioning). Tea quality difference minimal: Blind taste tests (consumers—can't reliably distinguish PG Tips from Tesco bags, both use Kenya/Assam CTC blends sourced from same auctions, quality specs nearly identical).

Where brand premium goes: Advertising spend (PG Tips/Tetley—£20-40 million annually UK market, amortized across 500+ million boxes sold = £0.04-0.08 per box marketing cost), NPD and innovation (pyramid bags/cold-brew/decaf variants—R&D + new packaging lines, costs £0.05-0.10 per box), brand profit margin (Unilever/Tata—extract 10-15% net margin on branded vs. 5-8% on private label, premium positioning allows). Retailer behavior: Loss leader strategy (Tesco sells PG Tips £3.50—pays £2.80-3.00 wholesale, minimal margin to drive foot traffic, subsidizes with high-margin own-label), promotional cycles (branded tea on offer 40-50% of time—"Was £4.50 now £3.00", trains consumers never pay full price, see promotional dependency).

Cost Per Cup Reality Check

Tea bag economics per serving: £2 box ÷ 80 bags = 2.5p per cup (cheapest caffeine source—vs. instant coffee 8-12p, espresso capsule 25-40p, see recession appeal), milk costs more than tea (50ml milk per cup = 5-8p—exceeds tea bag cost, sugar another 1-2p, tea itself minor cost component in "cuppa" total). Bulk loose leaf comparison: 1kg loose CTC £8-12 retail (makes 400-500 cups—works out 1.6-3.0p per cup, 20-30% cheaper than bags but convenience penalty), specialty loose leaf (£30-50 per kg—6-10p per cup, premium justified by quality difference unlike commodity CTC where bags vs. loose functionally identical). Value hierarchy: Supermarket bags best value-convenience ratio (marginal extra cost vs. loose offset by ease + consistency), branded bags pay for advertising not quality (PG Tips drinkers funding TV commercials), specialty loose leaf only premium worth paying (actual quality difference vs. commodity tea).

4. Packet Size Psychology: Why 40-Bag Boxes Cost More Per Bag

Packet size pricing (same brand): 40-bag box (£1.80-2.20—4.5-5.5p per bag), 80-bag box (£3.00-3.50—3.75-4.4p per bag, 15-20% cheaper per bag than 40-count), 160-bag box (£5.50-6.50—3.4-4.1p per bag, bulk discount extends), 300-bag catering pack (£9-11—3.0-3.7p per bag, maximum economy of scale). Why smaller packs cost more per unit: Packaging overhead (40-bag box—requires same cardboard/printing as 80-bag proportionally, doubles per-bag packaging cost), shelf space economics (retailers—prefer selling fewer large packs, charge brands premium for small-pack shelf slots), consumer psychology (small pack buyers—less price-sensitive, purchasing convenience/trial not value, retailers exploit with higher per-unit pricing).

Volume discounts breakdown: 40 → 80 bags: Save 15-20% per bag (economies of scale packaging + retailer bulk incentive), 80 → 160 bags: Save additional 8-12% (diminishing returns—most efficiency gains captured at 80-count), 160 → 300+ bags: Save 5-8% more (marginal at this point—buying catering packs approaches wholesale pricing). Optimal consumer strategy: Buy 80-160 count boxes (sweet spot—captures most bulk discount without tying up cash in excessive inventory or risking staleness, 300-bag packs take 6-12 months household consumption tea oxidizes see freshness loss), avoid 40-count (unless trying new brand—convenience premium unjustified 20% higher cost for same product).

5. Private Label vs. Branded Economics: The Tesco Tea Racket

Private label strategy (retailer perspective): Source from same estates (Tesco own-label—contracts directly with Kenya/Assam estates, bypasses branded intermediaries, saves 20-30% on procurement), minimal marketing spend (no TV ads—relies on shelf placement + Tesco brand trust, marketing cost <1% vs. 8-12% for PG Tips), higher retailer margin (Tesco—makes 35-45% gross margin on own-label vs. 15-25% on branded, incentivized to push private label aggressively). Quality parity: Same CTC sources (Tesco buyers—attend Mombasa auction purchase BP1/PF1 grades identical to what Unilever buys for PG Tips), blending expertise (contract blenders—Tesco outsources to same facilities that pack branded tea, quality control equivalent).

Why branded tea persists despite price premium: Consumer loyalty/habit (older demographics—grew up with PG Tips/Tetley, brand switching rare even when price 50-100% higher), perceived quality difference (psychological—"you get what you pay for" belief, taste expectations influence sensory experience even when tea identical), risk aversion (new buyers—default to recognized brand, avoid "cheap" own-label perceived as inferior despite objective parity). Market share evolution: Private label gaining (UK tea market—30% own-label 2000 → 45% own-label 2020, recession periods accelerate shift see trading down), branded defending with innovation (cold-brew bags, specialty blends, recyclable packaging—differentiation attempts to justify premium, limited success commodity CTC hard to differentiate meaningfully).

6. Bulk Discounts and Promotional Pricing Cycles

Typical promotional cycle (UK supermarkets): Regular price (£4.50 for 80-bag branded box—4-6 weeks duration, rarely sold savvy consumers wait for deals), promotional price (£3.00-3.50—"Was £4.50 save £1.00", 2-3 weeks duration, 60-70% of volume sold during promo periods), multi-buy deals ("2 for £6" or "3 for £8"—encourages stockpiling, effective price £2.67-3.00 per box), loyalty card bonus (Tesco Clubcard—extra 10-20% off promo price for members, drives app engagement + data collection). Why constant promotions? Competitive necessity (if Tesco runs £3 PG Tips—Sainsbury's must match or lose market share, race to bottom on commodity products), manufacturer funding (Unilever—subsidizes retailer promotions, pays £0.50-1.00 per box promotional allowance to secure shelf space + volume).

Consumer behavior impact: Promotional dependency (75-80% of tea buyers—only purchase on promotion, full-price sales negligible), stockpiling waves (households buy 3-6 boxes during promo—3-6 months supply, creates demand volatility for manufacturers), brand erosion (constant discounting—undermines premium positioning, consumers anchor to £3 not £4.50 as "real" price). Manufacturer dilemma: Promotion spending unsustainable (Unilever—spends 15-20% of revenue on trade promotions, squeezes profit margins but cutting promos loses shelf space to competitors), alternative strategies limited (premium NPD—pyramid bags/specialty blends, niche volumes insufficient offset commodity decline, see market bifurcation).

7. Global Comparison: Why US Tea Bags Cost 2-3x UK Prices

Price disparities (80-bag equivalent): UK: £2-4 (£30-60/kg—highly competitive market, tea drinking culture drives volume/efficiency), US: $5-10 (£60-120/kg—smaller market fragmented, coffee dominance limits tea scale economies), Germany: €3-6 (£40-75/kg—moderate tea consumption, positioned between UK/US), India domestic: ₹100-200 (£15-30/kg—production country advantage, local CTC dirt cheap but packaging costs converge with global). Why US tea expensive: Lower volume (Americans consume 0.3 kg tea per capita annually—vs. UK 2.0 kg, 85% less demand means less retail competition + smaller pack sizes dominate), import logistics (tea shipped to West Coast—then trucked nationwide, adds $0.50-1.00/kg vs. UK direct to major distribution hubs), coffee substitution (tea competes with coffee not primary beverage—priced as specialty not commodity, see category positioning).

Market structure differences: UK: Dominated by big brands (PG Tips/Tetley/Yorkshire—70% market share, economies of scale + promotional warfare keeps prices low), US: Fragmented specialty (Lipton largest but <30% share—hundreds of specialty brands, premiumization focus vs. commodity volume, average selling price 2-3x UK equivalent). Future convergence unlikely: Cultural entrenchment (UK tea-drinking habit—supports commodity pricing efficiency, US coffee-centric unlikely to shift dramatically, tea remains niche higher-margin category), e-commerce impact (Amazon—enables bulk buying direct from UK, some US consumers import Twinings/Yorkshire Tea cheaper than buying domestically, arbitrage limited by shipping costs for heavy low-value commodity).

Comments