1. Auction Catalog Structure: Finding the Critical Information

Pre-auction catalog components: Header information (sale number—e.g., "Sale 33/2023", auction date, viewing dates 1-2 days prior for physical inspection), broker details (African Tea Brokers ATB, Tea Brokers East Africa TBEA, George Williamson—3-4 major brokers dominate Kenya/Malawi auctions, see broker economics), lot count (typical Mombasa sale 8,000-12,000 lots—impossible to inspect all, professionals focus on specific grades/origins based on buyer needs). Lot entry format: Mark identification (estate code + invoice mark—e.g., "KB/305" Kipkebe Estate invoice 305, unique identifier for traceability), grade designation (BP1, PF1, PD, D1 for CTC blacks—see grade breakdown below, orthodox teas use FTGFOP/SFTGFOP naming), package count and weight (e.g., "150 packages 30kg = 4,500kg total"—multiply to verify invoice weight, discrepancies flag potential issues).

Taster notes and prompt marks: Professional taster description (2-4 word flavor profile—"Brisk, bright, full-bodied", "Weathery, dull, weak", coded language critical for value assessment), prompt notation ("P" or blank—P = estate requests price quote before bidding, indicator of confidence in quality, blank = accepts auction bid whatever result), valuation range (some catalogs list broker estimate—"$2.80-3.20/kg", helps buyers calibrate expectations, actual sale may vary ±15-20% from estimate). Sample request process: Pre-auction sampling (buyers request specific lot samples—broker couriers deliver 50-100g portions, professional cuppers taste 200-500 samples per sale week, decision framework refined over years), cupping methodology (standardized tasting—3g tea + 150ml boiling water + 5 minutes steep, evaluate liquor color/aroma/taste/mouthfeel, compare against reference standards for grade).

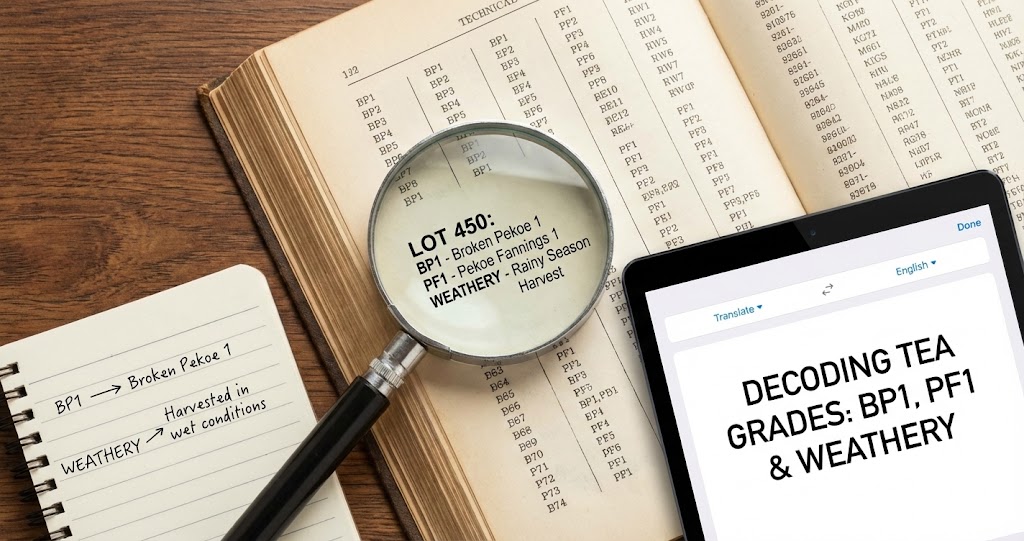

2. CTC Grade Codes: BP1, PF1, PD, and the Particle Size Hierarchy

BP (Broken Pekoe) grades: BP1 (Broken Pekoe One): Largest CTC particle 2-3mm (top grade for CTC—highest liquor strength + flavor complexity, commands $2.80-3.20/kg at Mombasa, 15-20% of total CTC production), BP Special: Premium BP1 selection (exceptional estates only—Marinyn/Kangaita produce consistent BP Sp, adds $0.20-0.40/kg premium vs. standard BP1), BP2/BP3: Lower broken pekoe tiers (smaller particle size or mixed quality—$2.50-2.90/kg, used in mid-tier blends see blend economics). Broken Pekoe characteristics: Liquor profile (full-bodied—robust malty notes, brisk astringency, dark reddish-brown color), typical use (premium tea bag blends—PG Tips/Tetley use 30-50% BP1 in signature blends for strength + character), brewing tolerance (forgiving—maintains quality even with 5-6 minute steep, consumer home brewing conditions).

| CTC Grade Code | Particle Size (mm) | Typical Price ($/kg Mombasa) | Primary Use | % of Total Production |

|---|---|---|---|---|

| BP1 (Broken Pekoe One) | 2.0-3.0mm | $2.80-3.20 | Premium tea bags (strength + character) | 15-20% |

| PF1 (Pekoe Fannings One) | 1.0-2.0mm | $2.50-2.90 | Standard tea bags (volume blends) | 50-60% |

| PD (Pekoe Dust) | 0.5-1.0mm | $2.20-2.60 | Instant tea / quick-brew bags | 15-20% |

| D1 (Dust One) | <0.5mm | $1.80-2.40 | Iced tea powder / instant mixes | 10-15% |

| Bmix (Below Mix) | Variable (off-spec) | $1.20-1.80 | Extraction / animal feed | 2-5% |

PF (Pekoe Fannings) dominance: PF1 (Pekoe Fannings One): Workhorse grade 1-2mm particles (50-60% of CTC production—largest volume grade, $2.50-2.90/kg price, standard tea bag filler globally), brewing speed (fast extraction—30-90 seconds acceptable steep time, ideal for tea bags where consumer wants quick brew, see British quick-brew culture), blending versatility (mixes well with BP1—typical blend 30% BP1 + 60% PF1 + 10% PD balances strength/cost/color). Dust grades (PD/D1): Commercial applications (iced tea production—rapid cold extraction for foodservice, instant tea powder—spray-dried concentrates, budget tea bags—lower-cost products sacrifice some flavor for price), price discount rationale (smaller particle = faster staling—oxidation surface area increases, 6-12 month shelf life vs. 18-24 months BP1, warehousing risk reflected in pricing, see oxidation dynamics).

3. Taster Terminology: Decoding "Brisk," "Weathery," and "Bakey"

Positive quality descriptors: "Brisk" (desirable astringency—lively mouthfeel, indicates proper withering + oxidation, commands premium $0.10-0.30/kg vs. "soft" equivalents, critical for British-style breakfast tea see builder's tea standards), "Bright" (clear liquor—good sorting, no dust contamination, visual appeal in cup, often paired with "brisk" as "brisk and bright" top descriptor), "Full-bodied" (substantial mouthfeel—not thin or weak, high soluble solids content, desirable for milk tea applications which dominate CTC markets). "Fruity": Orthodox tea descriptor (Darjeeling/Ceylon orthodox—muscatel/stone fruit notes, premium indicator for whole-leaf teas, rare in CTC blacks where "malty" preferred), "Malty" (Assam characteristic—caramel/bread notes, CTC processing accentuates maltiness, pairs well with milk + sugar British palate preference).

Negative quality indicators: "Weathery" (moisture damage during drying—musty/stale aroma, indicates rain exposure during withering or poor factory conditions, 30-50% price discount vs. clean equivalent, major red flag in auction catalogs), "Bakey" (over-fired during final drying—burnt/harsh notes, factory temperature control failure, drinkable but character compromised, 20-30% discount), "Dull" (lifeless liquor—lack of brightness/briskness, often accompanies "weak" or "thin", suggests stale leaf or poor processing, avoid unless heavily discounted for extraction use). "Greenish": Under-oxidation signal (CTC blacks should be fully oxidized—greenish tint indicates incomplete fermentation, astringent in wrong way lacks developed flavor, 25-40% discount reflects need for re-blending to mask defect).

Professional Buyer's Catalog Workflow

Pre-auction week process: Monday catalog release: Brokers publish digital catalogs (8,000-12,000 lots Mombasa—overwhelming volume, professionals use filters to narrow focus), keyword filtering strategy: Search "brisk" + "BP1" + specific estates (Marinyn, Kangaita, Jamji—known quality producers, <50 lots to sample vs. thousands), avoid weathery/bakey flags: Exclude catalogs with negative descriptors (saves sampling time—focus only on clean lots likely to meet spec). Tuesday-Wednesday sampling: Request 30-50 lot samples (broker delivers to buyer's cupping room—standardized tasting 3g/150ml/5min steep, score each lot 1-10 scale for liquor color/aroma/taste/body), Thursday valuation: Determine maximum bid for each target lot (cost model: $2.85/kg max for BP1 "brisk bright full" given $3.20/kg retail need + 10% margin), Friday auction: Attend in-person or submit proxy bids (brokers bid on behalf if buyer absent—common for international buyers, 1-2% commission on purchases see broker compensation). Post-auction reconciliation: Wins vs. losses analysis (target 60-70% win rate on bids—100% = overbidding, <40% = too conservative missing opportunities, refine valuation model based on results for next sale).

4. Lot Numbering and Estate Codes: Traceability Essentials

Mark identification system: Estate codes (2-4 letters): Unique identifier for producer (KB = Kipkebe, MR = Marinyn, KG = Kangaita—registered with auction house, prevents duplicate marks), invoice number (3-4 digits): Sequential production batch within season (e.g., KB/305 = Kipkebe's 305th invoice this year—traceability to specific production date/factory batch), combined mark format: "KB/305 BP1 150 pkgs @ 30kg" (complete lot specification—estate + invoice + grade + quantity, basis for contract once hammer falls). Why traceability matters: Quality consistency tracking (buyers monitor specific estates over time—if KB/280-290 were excellent, KB/305 likely similar quality assuming no weather/factory changes, historical performance data valuable), defect liability (if moisture/contamination found post-delivery—invoice mark identifies responsible estate, damages/rejection possible, estates guard reputation carefully see quality reputation economics).

Factory blending transparency: Single-estate lots vs. blends: Premium estates sell single-origin (KB = 100% Kipkebe tea—transparency commands premium, buyers trust consistent terroir/processing), bought-leaf blends: Factories processing smallholder leaf (mark may be factory code but source mixed farms—less consistency, 10-20% discount vs. single-estate equivalent, common in Malawi/Tanzania markets), "Mix" suffix flag: "KB/305 MIX" indicates blend of grades or production dates (factory clearing inventory—may combine BP1 + BP2 particles or multiple days' production, reduces price 15-25% due to inconsistency risk). Repack lots: "RP" designation: Repacked from original invoice (could indicate storage transfer or contamination remediation—investigate why repacked, often 20-30% discount vs. original pack), damaged package recovery: Auction houses repack torn/water-damaged bags (disclose damage in catalog notes—"RP - Water Damaged Warehouse 3", severe discounts 40-60% common but still saleable for extraction use).

5. Price Trend Interpretation: Reading Between the Auction Results

Week-over-week price movement signals: BP1 price increase +5-8%: Indicates demand surge (major buyer restocking—Unilever/Tata contracts triggering, weather concerns in origin—drought forecast reducing future supply expectations, speculative buying ahead of currency devaluation see price volatility), gradual decline -2-3% per week: Normal seasonal pattern (post-peak flush glut—April-May Kenya production peaks, supply increase depresses prices June-August, predictable cycle allows planning). Grade spread analysis: BP1-PF1 premium widening: $0.30 → $0.50/kg spread (quality flight—buyers willing to pay more for top grade, suggests blenders prioritizing brand quality over cost in competitive market), premium compression: $0.30 → $0.15/kg (commodity pressure—price competition forcing blenders to downgrade formulations, cost-cutting cycle often precedes recession see recession tea demand).

Origin-specific price divergence: Kenya premium over Malawi: Kenya BP1 $3.00/kg vs. Malawi BP1 $2.50/kg (quality perception—Kenyan CTC brighter/brisker reputation, brand cache for "Kenya" origin on retail packaging, terroir differences genuine but also marketing premium), estate hierarchy within origin: Marinyn BP1 $3.20 vs. generic Kenya BP1 $2.90 (top estates command 10-15% premium—consistent quality track record, buyers pre-committed to specific marks, see relationship premium economics). Unsold lot analysis: High unsold rate 30-40%: Buyer hesitation signal (overpricing by estates—reserve prices too high, quality concerns after sampling, market oversupplied, next sale likely sees 5-10% price reduction to clear inventory), bidding wars multiple buyers: Scarcity indicator (specific desirable lot—competition drives 10-20% above broker estimate, signals tight supply for that quality tier).

6. Orthodox Tea Nomenclature: FTGFOP, SFTGFOP Decoding

Orthodox whole-leaf grade system: FTGFOP (Finest Tippy Golden Flowery Orange Pekoe): Top whole-leaf grade (abundant golden tips—young leaf buds, indicates first flush or high-quality plucking, Darjeeling FTGFOP $15-30/kg vs. CTC BP1 $3/kg, see flush pricing), SFTGFOP (Special Finest...): Ultra-premium designation (exceptional estates only—Castleton/Makaibari/Margaret's Hope Darjeeling, $30-60/kg, often auction-specific lots for collectors), TGFOP (Tippy Golden...): Standard premium grade (good whole-leaf—less tips than FTGFOP, $10-20/kg typical Ceylon/Assam orthodox). Lower orthodox grades: FOP (Flowery Orange Pekoe): Decent whole-leaf (no tip requirement—coarser pluck, $6-12/kg, everyday orthodox tea), OP (Orange Pekoe): Basic whole-leaf ($4-8/kg—larger leaf size, longer plucking standard, lower quality than FOP), Broken grades (FBOP, BOP): Orthodox leaf cut smaller (not CTC crush—mechanical cutting, $3-6/kg, faster brewing than whole-leaf but less prestigious).

Tip content significance: Golden tips = young buds: High amino acid content (L-theanine—umami/sweetness, smooth mouthfeel, less astringent than mature leaf, prized by connoisseurs), tip % correlation to price: 20-30% tips (standard FTGFOP—$15-25/kg), 40-60% tips (exceptional SFTGFOP—$40-80/kg), >70% tips (rare silver needle whites—$100-300/kg, see artisan processing). Regional orthodox distinctions: Darjeeling: Muscatel notes (first flush FTGFOP—fruity/floral, second flush SFTGFOP—muscatel/amber liquor, autumnal FOP—mellow/malty), Ceylon: Brightness emphasis (high-grown FTGFOP—Nuwara Eliya/Dimbula, brisk citrus notes, medium-grown BOP—stronger body less brightness), Assam orthodox: Malty robust (TGFOP common—full-bodied breakfast tea character, golden tips add honeyed sweetness but maintain strength).

7. Catalog Red Flags: What Professional Buyers Avoid

Quality warning signs in descriptions: "Dull and weak" combination: Worst descriptor pairing (lifeless tea—no redeeming qualities, expect 50-70% discount vs. equivalent grade, only suitable for heavy blending to mask in low-cost products), "Slightly weathery": Understatement flag (brokers minimize defects—"slightly" often means significantly, request sample essential to assess true severity, 30-40% discount minimum), "Greenish and light": Under-oxidation + weak (double defect—immature processing + insufficient leaf, 40-50% discount, difficult to blend out requires expert tea master). Estate-specific risk signals: New/unknown mark codes: No track record (new factory or rebranded estate—quality uncertainty, approach cautiously until reputation established, 15-25% discount for novelty risk), inconsistent quality history: Estate fluctuates sale-to-sale (management issues or variable sourcing—KB/280 "brisk bright" then KB/285 "dull bakey", unreliable supplier for contract blending, buyers avoid or demand discount buffer).

Structural auction concerns: Unusually large lot sizes: Single invoice 20,000-30,000kg (normal 3,000-8,000kg—oversized suggests estate dumping quality issue or desperate for cash, investigate why such large single offering), multiple repacks from same estate: "KB/301 RP, KB/302 RP, KB/303 RP" (pattern of repack lots—signals systemic storage or quality control problems, factory issues affecting multiple invoices, avoid estate entirely until resolved). Timing red flags: Off-season production: Kenya December-January lots (rainy season—quality typically poor, factories running to cover costs not because of good leaf, heavily discounted but even then often poor value), old crop designation: "2022 crop sold 2023" (staling issue—tea should move through auction within 2-4 months of production, 6+ month inventory suggests initially unsold due to quality/price, further deterioration likely, see freshness decay, avoid unless deep discount 50-60% justifies blending experimentation).

Comments